Responsible investment

A leader in responsible investment

For over 15 years, Bâtirente has worked with intensity and conviction to promote responsible finance, establishing itself as a well-known and respected industry leader. This innovative approach to fiduciary responsibility helps to combine the development of our members’ patrimony and the social values we are rooted in with the necessity of putting our capital at the service of society’s progress.

We believe that actively managing the environmental, social and governance (ESG) risks that the enterprises in our investment portfolios are exposed to contributes to the sound capitalization of retirement and to the long-term economic and social development needed for sustainable financial performances.

Bâtirente bases its responsible investment action on the Principles for Responsible Investment (PRI) of which we were among the first signatories when it were launched in 2006.

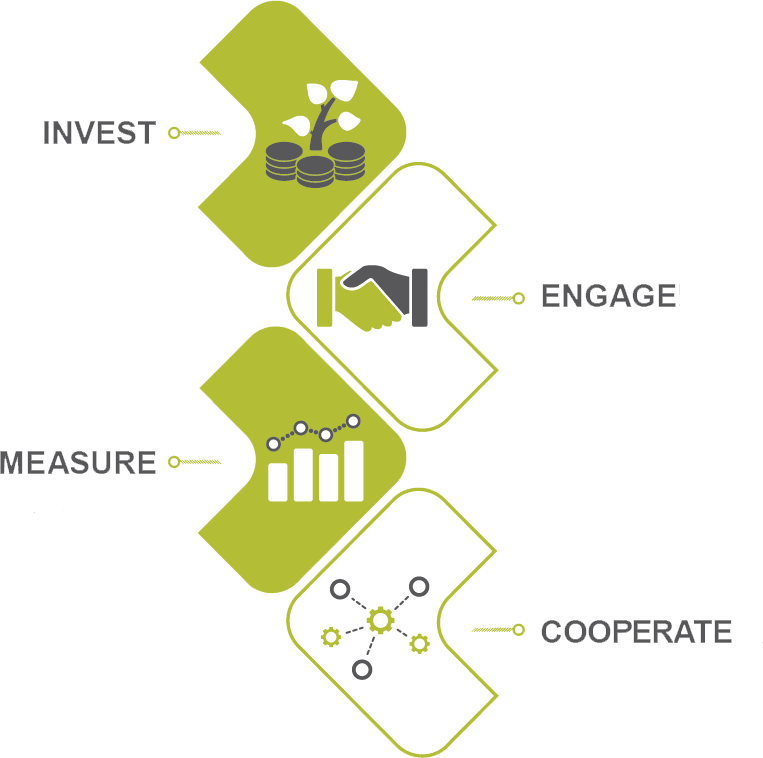

Our engagement revolves around four pillars:

INVEST

We consider environmental, social and governance (ESG) criteria in our investment decisions.

ENGAGE

We hold dialogues with the firms in which we invest to encourage them to deploy sustainable business models and we also encourage financial regulators to raise their requirements in order to promote these models.

MEASURE

We advocate an increased transparency from the entities and require the disclosure of relevant ESG information.

COOPERATE

We partner with local and global financial communities to develop responsible investment, foster dialogue, and share best practices.

Read the document Responsible investment to learn more about Bâtirente’s leadership in responsible investment.